Corporate Governance

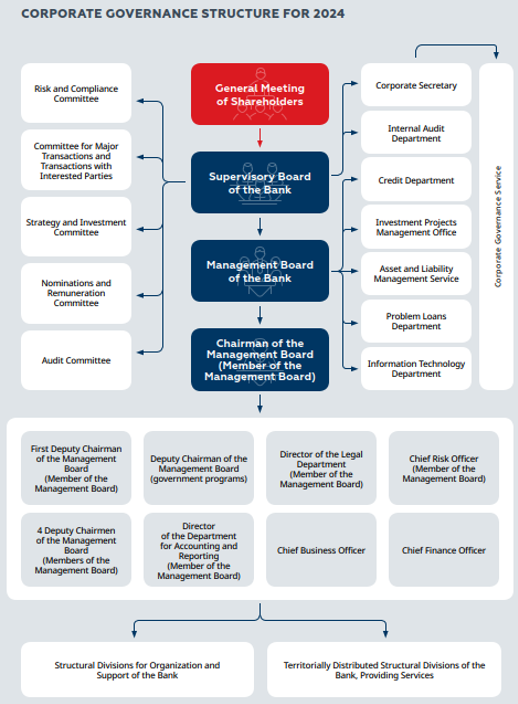

The corporate governance and executive management system of JSCB “Uzbek Industrial and Construction Bank” represents a framework of relationships among shareholders (owners), the Supervisory Board, the executive body — the Management Board, and other stakeholders. This system defines the rules and procedures for corporate decision-making and ensures the effective management and oversight of the Bank’s activities.

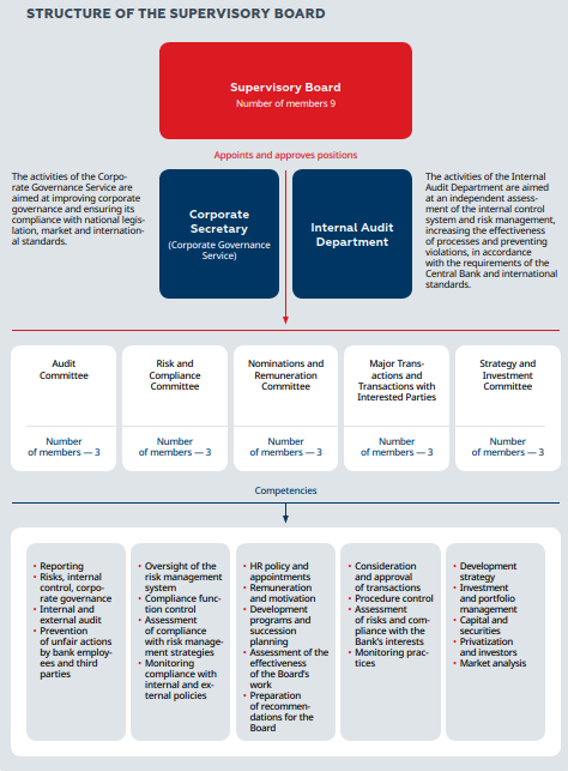

The highest governing body of the Bank is the General Meeting of Shareholders, which is convened at least once a year. The annual reporting meeting of shareholders is held each year before July 1. To ensure sustainable business development and adherence to high standards of corporate governance, and in accordance with the Law of the Republic of Uzbekistan “On Banks and Banking Activities,” the General Meeting of Shareholders on April 10, 2025, elected nine members to the Bank’s Supervisory Board for a three-year term. Of these, seven are independent members, representing 77.77% of the Board’s composition. The Chairman of the Board was also elected from among the independent members.

The independent members elected to the Supervisory Board are foreign professionals with extensive international experience in corporate governance of financial institutions and banks. Their expertise and professional background serve as an important factor for the further development of the Bank’s corporate governance system, the effective adoption of strategic decisions, and the conduct of operations in line with international standards.

At the first meeting of the newly elected Supervisory Board, which was formed at the annual General Meeting of Shareholders, the Chairman and Deputy Chairmen of the Board are elected, and five Board Committees are established from among its members.

To ensure sustainable and consistent development, the Bank has also implemented an effective system of internal and external control, carried out by the Bank’s Internal Audit Service, as well as regular inspections by independent auditing firms to verify the Bank’s financial statements’ compliance with International Financial Reporting Standards (IFRS).

Development of corporate governance is one of the Bank’s strategic priorities. To maximize transparency and the soundness of management decisions, the Bank adheres to a policy aimed at improving the accessibility and quality of information about its activities. This policy is implemented through the Bank’s official website and the mass media.

Presidential Decree of the Republic of Uzbekistan dated May 12, 2020, “On the Strategy for Reforming the Banking System of the Republic of Uzbekistan for 2020–2025,” emphasizes the need to develop and improve the corporate governance system, as well as to gradually privatize the state’s share in banks. The document highlights that one of the key objectives of banking reform is to create an effective management mechanism and further develop corporate governance — a vital condition for attracting foreign investment, since a stable and successful economy cannot exist without a resilient banking sector.

Therefore, the Bank is making every effort to further enhance its corporate governance system and implement internationally recognized financial and managerial practices.

Last updated date: 31.10.2025 12:30