500 mln so‘mgacha

Kredit miqdori

36 oygacha

Kredit muddati

6 oygacha

Imtiyozli davr

UZS

Kredit valyutasi

28 % dan boshlab

Yillik kredit stavkasi (so‘m)

Mikro va kichik biznes

Segment

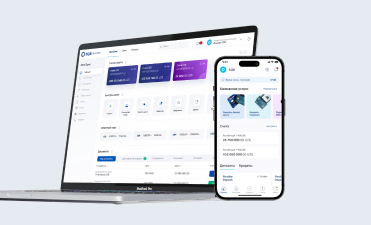

Bank mijoziga aylaning va hisob raqamingizni SQB Business ilovasiga biriktiring

Ilova orqali ariza yuboring va avtomatik tekshiruvdan o‘ting

Shartnomani E-Imzo orqali imzolang va kredit mablag‘larini oling

Kreditning maqsadi:

biznesning joriy ehtiyojlari uchun

Valyuta:

• milliy valyuta — so‘m

Ajratish shakli:

• SQB Business ilovasi orqali onlayn

• kredit bir martalik tarzda ajratiladi

Qarz oluvchilar toifasi:

• yuridik shaxslar

• yakka tartibdagi tadbirkorlar

Kredit muddati:

36 oygacha

Imtiyozli davr (differensial yoki annuitet):

kredit muddati 12 oygacha – 2 oygacha

kredit muddati 12 oydan 24 oygacha – 4 oygacha

kredit muddati 24 oydan 36 oygacha – 6 oygacha

Foiz stavkasi:

Milliy valyutada (so‘m):

• 12 oygacha – MB asosiy stavkasi + 14%

• 12-24 oy – MB asosiy stavkasi + 15%

• 24-36 oy – MB asosiy stavkasi + 16%

Ta'minot:

Kreditni qaytarmaslik xavfini qoplash bo‘yicha kredit summasining kamida 130% miqdorida sug‘urta polisi.

Mijozga qo‘yiladigan asosiy talablar (pasport bo‘yicha)

Faoliyat muddati:

Mijoz tadbirkorlik subyekti sifatida ro‘yxatdan o‘tgan va kamida 6 oy faoliyat yuritgan bo‘lishi kerak.

Kredit yuki:

Mijozning kredit yuklamasi 50 % dan oshmasligi kerak.

Skoring talabi:

KATM InfoScore bo‘yicha reyting 200 balldan kam bo‘lmasligi kerak.

So‘nggi 5 yillik kredit tarixi bo‘yicha cheklovlar:

Oyma-oy (muddati keyingi oygacha o‘tuvchi) prosrоchkalar ≤ 10 ta

31–60 kunlik kechikishlar ≤ 5 ta

61–90 kunlik kechikishlar ≤ 1 ta

90+ kunlik kechikishlar umuman bo‘lmasligi kerak

Qaror qabul qilish:

Kredit ajratish bo‘yicha qaror skoring tizimi orqali qabul qilinadi.

Kredit summasi mijozning qarz yuki ko‘rsatkichidan kelib chiqib belgilanadi.

Kerakli hujjatlar

Tashkilot egasining pasporti yoki ID‑karta

Korxonaning ustav hujjatlari (faqat yuridik shaxslar uchun)

Moliya hisobotlari (2‑shakl, foyda bilan) — yuridik shaxslar uchun

MyID orqali onlayn rozilik

Identifikatsiya va elektron imzolash uchun

Sug‘urta polisi

Kreditni qaytarmaslik xavfini qoplash bo‘yicha

Ariza topshirish jarayonida rasmiylashtiriladi

Last updated date: 20.11.2025 15:53