Favorable rates and flexible terms.

Expert assistance at all stages.

Eco-solutions for business.

Cost optimization and ecology.

Favorable rates and flexible terms.

Expert assistance at all stages.

Eco-solutions for business.

Cost optimization and ecology.

For the purchase and installation of renewable energy sources and eco-housing

Learn more

Invest in clean projects and support green initiatives with SQB

Analyze and optimize energy use to reduce costs and environmental impact

A wide range of financial tools and benefits for Green Banking users

.png)

Support for environmentally responsible initiatives promoting sustainable green energy development

.png)

Analyze environmental and social impacts to minimize risks and ensure sustainable development

We help follow green business practices and standards to ensure compliance

.png)

Implement strategies that help reduce environmental risks and strengthen your business resilience

A wide range of financial tools and privileges for Green Banking users

.png)

Sustainable Finance Department established

ESG policy and procedure developed. Eco-friendly products for corporate and retail business introduced

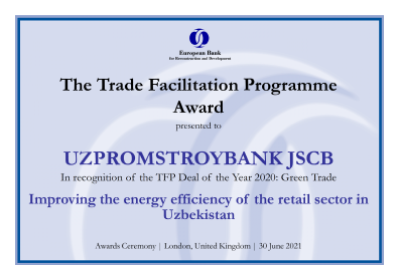

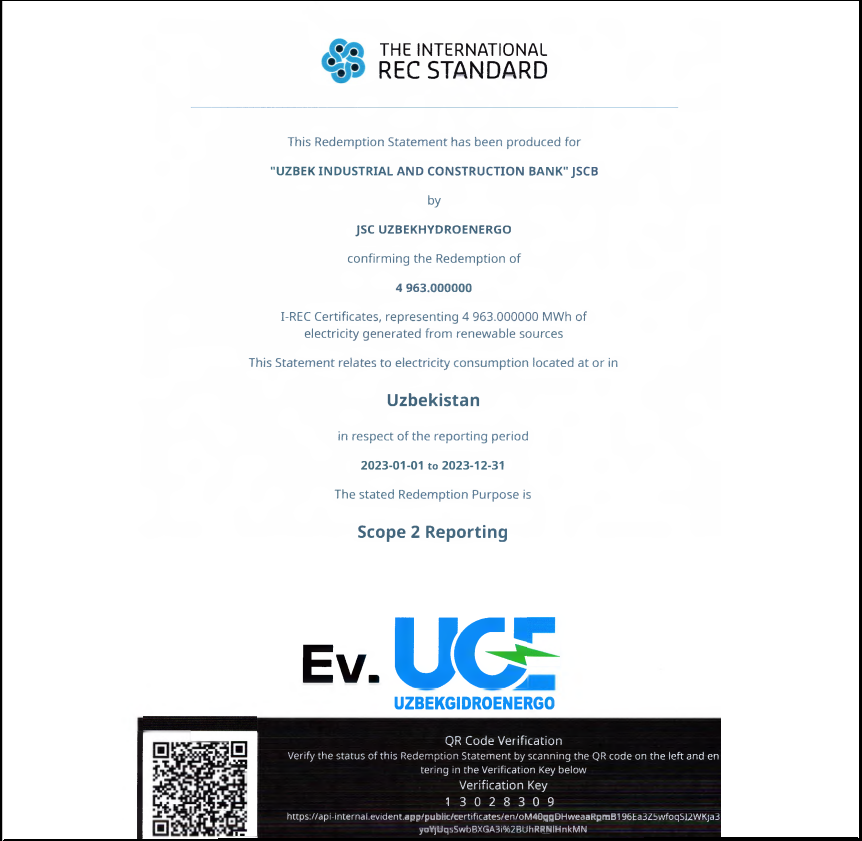

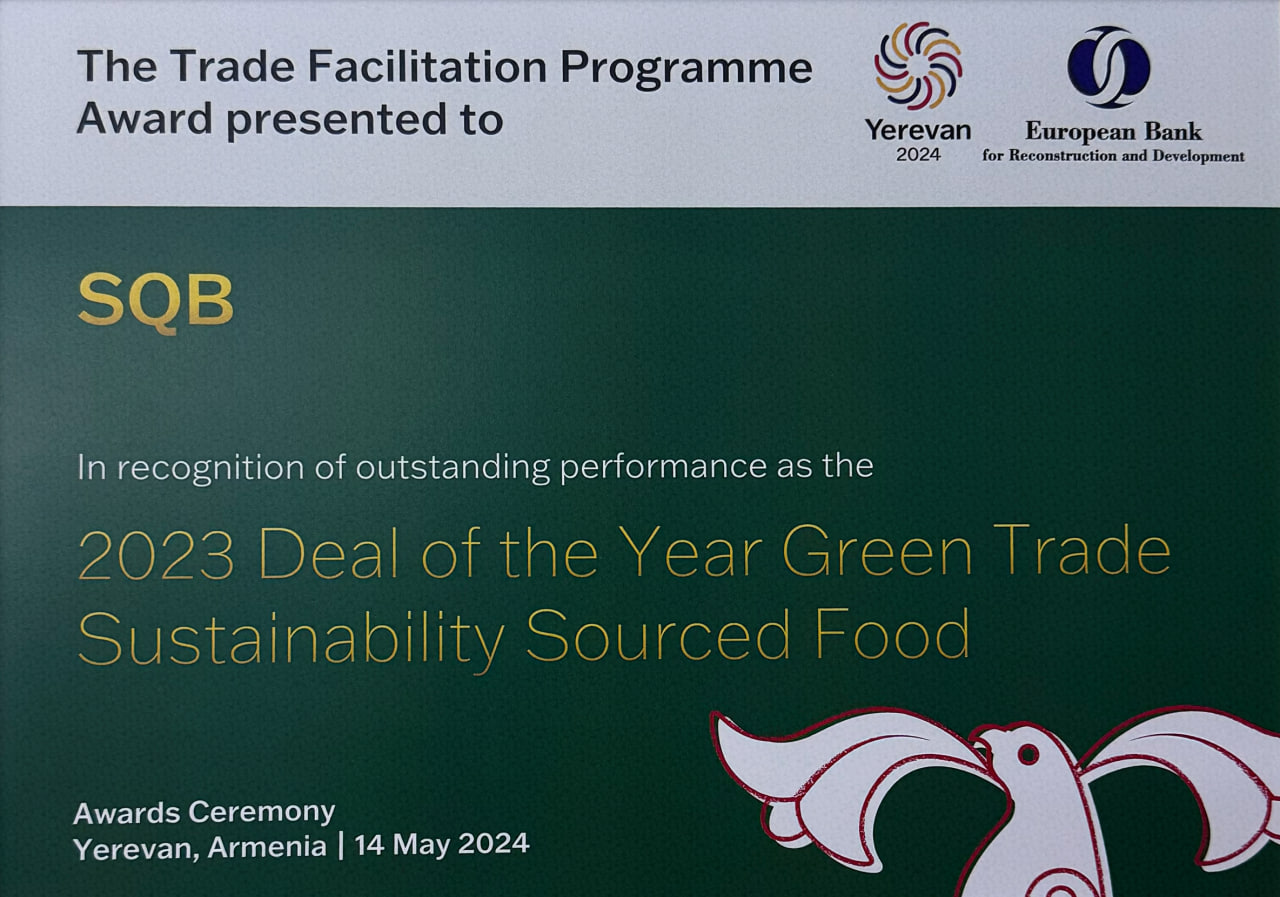

Eco-friendly products for SMEs developed. Business processes established. Green loan portfolios formed. EBRD TFP 2020 award: “Green Trade”

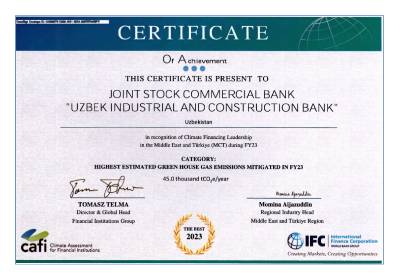

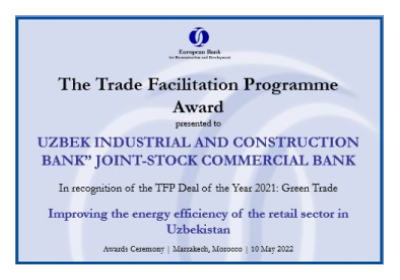

AIFC - Best Green Bank of 2020. EBRD TFP 2021 award “Green Trade”

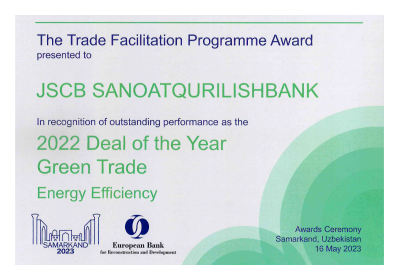

EBRD “Deal of the Year – Green Trade” award for promoting energy-efficient technologies in Uzbekistan

Promoting responsible consumption and use of all available resources

Supporting local communities and expanding social investments and charity programs

Promoting healthy lifestyles and access to quality and healthy products

Ensuring decent working conditions and equal opportunities for employees

For millions of people around the world, clean energy is not an abstract climate goal. It means a warm home in winter, a resilient business protected from rising energy costs, and clean ...

For the last 6 years, we have been actively promoting green initiatives in the industrial sector of Uzbekistan. Since the launch of Green Banking Department in 2019, we have joined the UN Gl ...

On September 13, 2025, Bukhara hosted the international Bukhara Night Race 2025, which this year was held alongside the first Bukhara Biennale. Since 2022, the night race has become a vi ...

Projects that have minimal impact on the environment.

Technologies, production processes, and supply chains that are environmentally friendly or less harmful compared to traditional production methods.

- Saving energy and natural resources;

- Reducing production costs;

- Waste recycling and processing;

- Reducing carbon dioxide emissions into the atmosphere.

ESG (Environmental, Social, Governance) is a system for assessing sustainable business development. It includes three key areas:

ESG is not only about ecology, but also about competitiveness and long-term success.

The ESG rating evaluates a company based on its sustainable practices. Major agencies such as MSCI, S&P Global, Sustainalytics analyze:

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)